Liquidity is vital for spurring growth and development for developing countries especially during crises for instance the unprecedented economic and health crises from the COVID-19 pandemic. The IMF, allocates Special Drawing Rights (SDRs), an international asset reserve that can be used to pay the IMF, exchanged with hard currency or be donated among member states. They can therefore be used by governments to stabilize their currencies, bolster their reserves or for social protection purposes which are overly important during crises.

On August 2021, the IMF allocated $650 billion worth of SDRs to its members to shore up the liquidity during the unprecedented health and economic crises due to COVID-19.

Food for thought…?

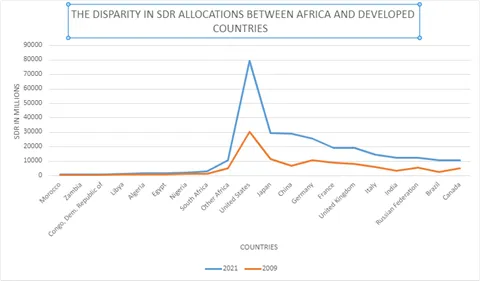

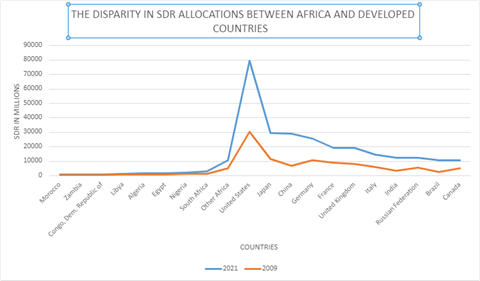

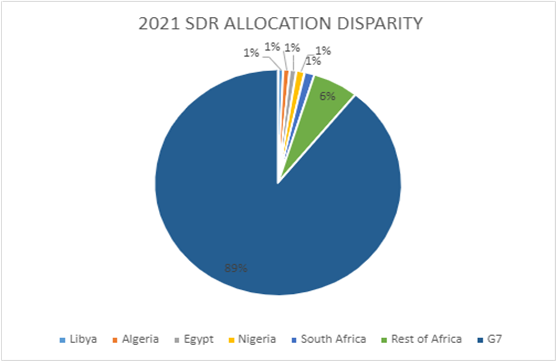

SDRs are important to developing countries for economic recovery. There’s however disparity in allocation where for instance the G7 as illustrated in the chart below, received close to 9 times what Africa received in 2021. This therefore means that the propensity for African countries and other developing countries to achieve the desirable liquidity levels to cushion their economies from unprecedented economic shocks is minimal.

Building forward together fairer…?

Provided high-income countries get the lion’s share of the SDRs allocation, the developing countries will always have little in their asset reserves to cushion their economies during dire economic disruptions, pay debts and finance sustainable growth and development. Through this, the global economy cannot build forward together fairer. Therefore, there is need to advocate for changes in allocation of SDRs to meet economic recovery needs for developing countries, improve access to needy countries and proposals to high income countries to voluntarily channel their excess SDRs to vulnerable countries through special grants run by IMF called the Resilience and Sustainability Trust (RST) so that they are in a better position to pay off their debts and spend on sustainable and wholesome economic growth and development. The RST conditionality should however be scrutinized to ensure that it does not harm the poorest, increase inequality, compromise gender equality and women’s rights and undermining human rights specifically those that require fiscal consolidation measures.