Date

24 February 2024

The invitation by the UK House of Commons to AFRODAD to give evidence on Africa’s debt is a testament that AFRODAD is a credible voice on behalf of the continent, on matters that concern debt and its intersectionality. The committee met on 20th February 2024.

The following were Jason’s main talking points:

- Africa’s debt crisis is a result of structural traps that keep the continent locked at the bottom of the global value and supply Chain. The perception or narrative that the crisis is more liquidity is misleading to the extent that African economies are not witnessing returns on investment of debt instruments before they are due.

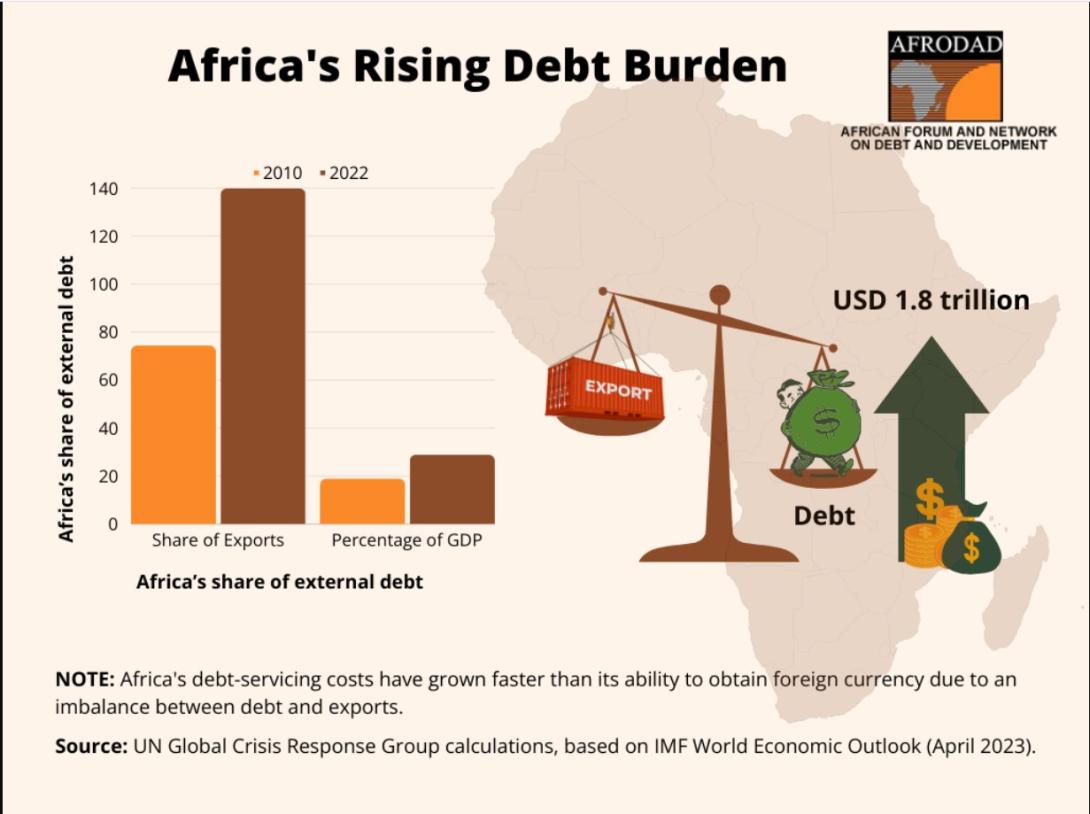

- In 2022, public debt in Africa reached USD 1.8 trillion. As a percentage of GDP, Africa’s share of external debt has risen from approximately 19% in 2010 to nearly 29% in 2022. Simultaneously, its external debt as a share of exports has risen from 74.5% to 140% over the same period. This latter point is important in Africa since many countries are reliant on exports, especially exports from the extractive industries with little value-added. The imbalance between debt and exports has made it more difficult for Africa to service its external debt as its ability to obtain foreign currency has grown at a rate lower than its debt-servicing costs.

- The appetite to access capital markets following the decline in access to concessional and grant financing has created a market for commercial and private debt. In the case of Africa, the cost of borrowing is discriminately high compared to other regions.

- Support the calls for legislation to be developed in the UK (city of London)

- The Common Framework is not effective! Accessing the Common Framework is undermined due to the risks of credit rating downgrades which then affect access to international capital markets, and therefore it is a vicious cycle of short-term.